As the number of investing platforms increases in Singapore, brokerages are trying harder to impress consumers. From slashing fees to offering free shares, they’ve come a long way from charging $25 in commissions for every trade.

Spoilt for choice, our number one question is now: which app is best for me?

That’s why we’ll take a look at the many investing apps in Singapore and how they stack up, covering aspects like:

- Fees and account minimums

- Access to global markets

- Sign-up perks

- Type of investor profile they’re best suited for

Read also: How to Start Investing as a Student [Step-by-Step Guide]

What to Look Out For in a Trading App

Choosing a platform depends on various factors. Some may prefer an intuitive — and less intimidating — interface. Others might want more technical analysis tools or advanced trading instruments.

Whatever your preference, here are a few things you’ll want to look out for in the trading platform you’ll be adopting:

- Ease of use. You should be able to make or close a trade immediately, or access charts and data without much tedium.

- Availability of real-time charts and data. Equity prices can jump quite a bit from one day to the next — or even within the span of a few minutes. You need up-to-date data to make good buying and selling decisions.

- Variety of educational and research materials. It’s hard to consistently make a profit without doing your due diligence.

- Little to no lag time between trade execution. You don’t want to put in your order only to find out that you missed out on profits (or made an unnecessary loss) because your app was too slow to push your order through.

- Ability to place conditional or limit orders in advance. This gives you the option to place orders when certain triggers are met (e.g. when a stock price drops below a certain amount).

12 Investing Apps for Singapore

| App | Type | Rating | Account Minimum | Best For |

|---|---|---|---|---|

| Webull | Trading App | 4 | None | Investors with limited capital who want to actively trade the US and HK markets at low cost |

| ProsperUs | Trading App | 4 | None | Investors who want wide market access at low cost |

| uSMART SG | Trading App | 4 | S$3,000 | Beginner investors looking to grow their knowledge and trade mostly in the SG market |

| TD Ameritrade | Trading App | 4 | US$25,000 | Buy-and-hold investors focusing on the US markets |

| SaxoTraderGo | Trading App | 4 | S$3,000 | Investors who want a beginner-friendly platform with access to a wide range of markets |

| Moomoo | Trading App | 4 | None | Younger investors looking to trade mainly the SG, HK, and US markets at low fees |

| Interactive Brokers | Trading App | 5 | None | Investors who want to grow their trading knowledge along with their portfolio and want access to many markets with low margin fees |

| FSMOne | Trading App | 4 | None | Investors who can afford to transact large amounts each trade and would benefit from the flat fee |

| Endowus | Robo-Advisor | 5 | S$1,000 | Investors who want to maximise their CPF and SRS funds through a robo-advisor |

| Syfe | Robo-Advisor | 4 | None | Investors with low starting capital looking for a long-term platform to grow their portfolio |

| StashAway | Robo-Advisor | 3 | None | New investors who want to trade global ETFs with the help of an algorithm. Investors who have over S$500,000 to invest will find StashAway more attractive |

| DBS DigiPortfolio | Robo-Advisor | 2 | S$1,000 | Investors looking for a convenient option linked to their DBS bank accounts |

Top 8 Trading Apps

These are apps meant for active — or at least more involved — investors. If you’re interested in learning about market dynamics and enjoy managing your own portfolio, we’d recommend one of these trading apps. But if you’d prefer a set-and-forget approach to investing, we’d recommend looking at robo-advisors instead.

Recommendation #1: Webull

Webull

Which trader profile is this app best for: Investors with limited capital who want to trade the US and HK markets without paying commissions.

Webull is a US-based, China-backed company known for their “true zero commissions” US and HK trading. They only began offering their services in Singapore in 2022, so they’re one of the newest brokers on this list.

Compared to the other brokers on this list, the main upside to investing with them is that you can trade US and HK stocks with no commissions or platform fees.

Commission & Fees:

- No commissions or platform fees for US stocks and ETFs

- No commissions or platform fees for HK stocks and ETFs

- 0.02% of trade (min. CNH12) and no platform fees for A-shares

Account Minimum: None.

Available on: Both iOS and Android

Perks:

- No subscription and redemption fees for mutual funds

Current promotion (Click to apply):

- Fund any amount and get 3 free fractional shares

- + Maintain for 30 days to get an additional 5 free fractional shares

Recommendation #2: ProsperUs

ProsperUs

Which trader profile is this app best for: Beginner investors – especially millennials – looking to learn and trade in a wide variety of markets at low cost.

ProsperUs by CGS-CIMB is a more recent entrant to the market, having launched mid-pandemic in March 2021. It’s not to be trifled with though: as a platform from an established brand, it has both reputation and reach.

Even as a new contender, it offers access to a huge list of markets from Singapore, HK, and China to Europe, Japan, Malaysia, Australia, Canada, and the US. Its fees also rival those of low-cost brokers like Moomoo and Interactive Brokers.

Commission & Fees (full list of ProsperUs fees):

- 0.06 – 0.10% for SG stocks and ETFs with no minimum commission

- 0.08 – 0.15% for HK stocks and ETFs (min. HKD20 – 40)

- USD5 flat fee for NYSE, NASDAQ, and American Stock Exchange trades with no minimum commission

- 0.08 – 0.10% on Australian stocks (min. AUD6 – 8)

Account Minimum: None.

Available on: Both iOS and Android

Perks (source):

- $100 cashback when you fund your account with $1,000 and make 3 buy trades

- Free 2x US stocks worth $60 for every successful referral

Recommendation #3: uSMART SG

uSmart SG

Which trader profile is this app best for: Beginner investors wanting to learn and trade primarily the Singapore markets.

An established name in Hong Kong, uSMART SG allows its users to trade the Singapore, HK, and US markets. It has a more limited selection of products compared to ProsperUs; you can’t trade mutual funds or forex, for example. You can, however, trade fractional shares on uSMART.

uSMART’s main selling point is that it’s among the lowest-cost brokers if you’re trading the SG markets. (We’d go with a different brokerage if you’re looking at the US markets though!) It also prides itself on the learning tools available for new investors.

Commission & Fees (source):

- 0.02% commission (min. SG$1) and 0.03% platform fee (min. SG$1.88) for SG stocks

- USD0.003 per share commission (min. US$0.50, max 0.5% of trade) and USD0.005 per share platform fee (min. US$1, max 0.5% of trade) for US stocks

- HK$12 platform fee and 0.024% commission for HK stocks, warrants, and CBBCs

Account Minimum: None, except for uSMART Intel accounts (minimum S$3,000)

Available on: Both iOS and Android

Perks (source):

- Zero platform fees for futures trading (limited to the first 100 applicants) with commissions as low as US$0.99. Deposit US$3,000 for 3 free months of futures quotes.

- Earn up to 4.6% p.a. interest for your idle funds (valid until 20 June 2023)

Which trader profile is this app best for: Beginner investors wanting to learn and trade primarily the Singapore markets.

Recommendation #4: TD Ameritrade

TD Ameritrade

Which trader profile is this app best for: Active day traders or buy-and-hold traders focused on the US markets.

Some years back, TD Ameritrade charged a US$10.65 commission for every trade. Ouch! But since the advent of zero-commissions brokerages, TD Ameritrade has also changed with the times.

What we like most about TD Ameritrade is the free real-time US market data and trading platform UX. (Some platforms, like IBKR, only offer delayed market data for free.) They also don’t charge any custodian or dividend handling fees.

Commission & Fees (source):

- $0 commission on US stocks (except for OTC stocks, which have a US$7.44 commission)

- $0 commission on US ETF trades

- $0 commission and $0.70 contract fees on US options

Account Minimum: None to open an account; US$25,000 to actively day trade

Available on: Both iOS and Android

Perks (source):

- US$100 rebate when you fund your account with at least US$3,500

Recommendation #5: SaxoTraderGo

SaxoTraderGo

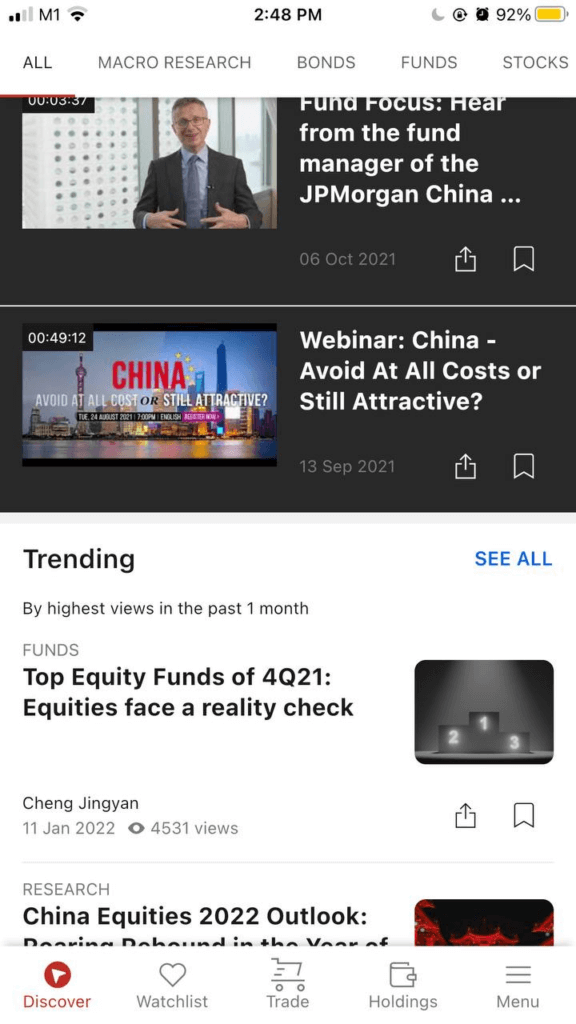

Which trader profile is this app best for: Knowledgeable investors who want access to international markets and leveraged instruments. New investors may prefer the SaxoInvestor platform instead due to its simpler interface.

SaxoTraderGo is Saxo Markets’ main investment app. With the mobile app, account holders can trade and get access to a research hub with analysis and educational content.

Apart from its fuss-free access to international markets, SaxoTraderGo’s fees are also competitive. You’ll get more discounts on fees the more you trade — or if you pay to upgrade your tier.

Fair warning though: Saxo charges a custodian fee for foreign assets. That means if you buy and hold international stocks for the long term, their pricing isn’t the most competitive.

Commission & Fees (source):

- 0.02% – 0.06% on US stocks with a minimum of US$1 – USD$4 depending on your plan’s tier

- 0.03% – 0.08% on SG stocks with a minimum of S$1 – S$5 depending on your plan’s tier

Account Minimum: S$3,000 on the free Bronze plan; no minimums otherwise.

Available on: Both iOS and Android

Perks:

- Saxo Rewards System: Earn points for every qualifying trade. Redeem points to upgrade plans for better service and lower commissions.

Recommendation #6: Moomoo

Moomoo

Which trader profile is this app best for: Younger investors looking for a low-cost platform to start learning about trading, or personal finance influencers who want to trade while engaging with a community.

Moomoo (full review) is a relatively new low-cost broker that’s a subsidiary of China’s Futu Holdings. The parent company, Futu, is backed by Chinese tech giant Tencent Holdings.

The trading platform only entered the Singapore market in March 2021. Despite this — or maybe because of this — it currently charges lower fees than Tiger Brokers while also offering access to the US, Hong Kong, and Singapore markets.

Commission & Fees (source):

- US$0.99/order on US stocks and ETFs

- 0.06% of transaction amount (minimum of S$0.99 per order) on Singapore stocks, ETFs, and REITs

- HKD15 + commission of 0.03% of transaction amount or HKD3 (minimum of HK$18 per order) for HK stocks and ETFs

Account Minimum: None, but you’ll only get the free shares with a minimum deposit of S$1,525, US$2,000 or HK$12,000.

Available on: Both iOS and Android

Perks (Click to apply):

- Welcome Bundle (For new sign-ups, valid till 31 August 2023):

- Get 5.8% p.a guaranteed returns in MooMoo Cash Plus (worth up to S$380) when you complete the first subscription to activate, maximum subscription of S$80,000

- 1 free SE stock (Shopee) (worth S$80) when you deposit a cumulative amount of ≥ S$3,000 & complete 3 buy trades in total

- 1 free AAPL stock (worth S$240) when you deposit a cumulative amount of ≥ S$10,000 & complete 5 buy trades in total

- 1 year of commission free trading for SG stocks

- Zero commissions for life in the US stock market

- Free Level 2 US Stock Market Data, Level 1 Singapore Market Data

Recommendation #7: Interactive Brokers (IBKR)

InteractiveBrokers

Which trader profile is this app best for: Investors who want to grow their trading knowledge along with their portfolio. Interactive Brokers isn’t the most beginner-friendly, but it gives you access to a wide range of markets and is well-known for having the lowest margin fees.

Compared to other low-cost brokers like Moomoo and Tiger, IBKR (full review) stands out as the largest trading platform by volume. They’re known for their low commissions and fees as well as extensive access to global markets.

Commission & Fees (source):

- 0.08% of trade value (minimum S$2.50 per order) for SGX trades

- 0.08% of trade value (minimum HK$18 per order) for all SEHK stocks

- US$0.005 per share (minimum US$1 per order) for all US stock trades

Account Minimum: None.

Available on: Both iOS and Android

Perks:

- Refer a friend to receive a flat $200 for each referral.

Recommendation #8: FSMOne

FSMOne

Which trader profile is this app best for: Investors practising a lump-sum strategy rather than dollar-cost averaging. FSMOne charges investors on a per trade basis with no platform fees, so the minimum commission fees may be slightly higher than those of other brokers. Buying more in each trade will help to reduce fees.

FSMOne is a local brokerage popular because of their flat commission fee of S$8.80 for SG stocks. This may seem a tad high considering all the other low-cost brokers out there, but the flat rate actually works out to lower commissions if you buy or sell a large amount every trade.

Commission & Fees (source):

- Stocks on SGX: S$8.80 per trade

- Stocks on HKEX: 0.08% per trade (minimum HK$50)

- Stocks on US exchanges: 0.08% per trade (minimum US$8.80)

- China A Shares: 0.08% per trade (minimum CNH40)

Account Minimum: None.

Available on: Both iOS and Android

Perks:

- Refer a friend and receive 1,000 Rewards Points.

- Receive Rewards Points for transactions, holdings, and buying new investment products for the first time. Points can redeem items from the FSMOne catalogue.

- 0% sales charge for unit trusts.

Top 4 Robo-Advisor Apps

Robo advisors are automatic investment services driven by an algorithm. They can handle and maintain your personal investment portfolio, understand your financial goals and risk appetites.

This is a great option for new traders and people who prefer a hands-off approach towards trading.

Read also: 5 Investment Tips for Beginners in Singapore

Recommendation #1: Endowus

Endowus (full review) is a homegrown fintech company that uses empirical data to help investors access time-tested, diversified strategies for the best returns.

Unlike traditional fund managers, Endowus doesn’t manage your money directly, but rather, ensures that the fund manager building your portfolio is reliable.

Commission & Fees:

- Cash:

- 0.6% (Up to $200,000)

- 0.5% (S$200,001 – $1,000,000)

- 0.35% (S$1,000,001 – $5,000,000)

- 0.25% (S$5,000,001+)

- CPF & SRS: 0.4%

Account Minimum: S$1,000

Available on: Both iOS and Android

Perks:

- S$20 access fee discount for every successful referral.

- Ability to invest CPF & SRS monies.

Which trader profile is this app best for: Investors who want to maximise their CPF and SRS funds through a robo-advisor.

Recommendation #2: Syfe

Robo-advisor Syfe (full review) offers auto-wealth generation and passive investing through its personalised portfolios.

During the registration process, you’ll answer a few questions that will help the platform automatically create a portfolio based on your risk profile and goals.

Syfe will then invest your funds for you and give you regular reports on your investments. You can also speak to a Syfe wealth expert if you want more details or personalised advice.

Commission & Fees: 0.35% – 0.65% with three tiers of Blue, Black, and Gold

- Annual management fees:

- 0.65% (Up to $20,000)

- 0.50% (S$20,001 – $1,00,000)

- 0.40% (S$100,001 – $500,000)

- 0.35% (S$500,001+)

- ETF management fee: 0.15 – 0.24%

- Currency conversion: 0.09 – 0.12% of amount converted

Account Minimum: None

Available on: Both iOS and Android

Perks:

- 3 to 6 months’ fee waiver (on up to S$50,000 in assets) and S$30 cash credit for every successful referral

Which trader profile is this app best for: Investors with low starting capital looking for a long-term platform to grow their portfolio. Syfe is also great for those interested in slowly getting more involved with portfolio management.

Recommendation #3: StashAway

As one of the first robo-advisors in the Singapore marketplace, StashAway (full review) is well-known in the sector. With no minimums and an intelligent investment framework, there’s a lot to like about StashAway.

On the flip side, StashAway is one of the pricier robo-advisors if you’re investing less than S$100,000.

Commission & Fees: 0.2% – 0.8% (lower fees the more you invest)

- 0.80% (Up to $25,000)

- 0.70% (S$25,001 – S$50,000)

- 0.60% (S$50,001 – S$100,000)

- 0.50% (S$100,001 – S$250,000)

- 0.40% (S$250,001 – S$500,000)

- 0.30% (S$500,001 – S$1,000,000)

- 0.2% (S$1,000,001+)

Account Minimum: None

Available on: Both iOS and Android

Perks:

- 6 months’ fee waiver (on up to S$10,000 in assets) for every successful referral.

Which trader profile is this app best for: New investors who want to trade global ETFs with the help of an algorithm. Also, investors who have over S$500,000 to invest will find StashAway more attractive.

Recommendation #4: DBS DigiPortfolio

Out of all the robo-advisors listed, this is probably the most convenient one as long as you have an existing DBS account.

Geared towards new investors, this robo-advisor features investment portfolios crafted by fund managers with 17+ years of experience in the DBS Investment Team. The app also uses AI to automate processes like rebalancing and monitoring.

The main downside is the flat management fee — unlike other robo-advisors, DBS doesn’t give you discounts on fees the more you invest.

Commission & Fees: 0.25 – 0.75%

Account Minimum: S$1,000

Available on: Both iOS and Android

Perks: None

Which trader profile is this app best for: Investors looking for a convenient option that is linked to their DBS bank accounts.