If you know a thing or two about investing, you would’ve heard of StashAway. As one of the first robo-advisors in the Singapore marketplace, StashAway is well-known in the sector.

Read also: Investment Tips for Beginners in Singapore

With affordable fees, no minimums, and an intelligent investment framework, there’s a lot to like about StashAway.

Today, we’ll cover more details about StashAway to help you decide if this is a tool that’ll give you an edge in investing:

- How StashAway Works

- Stashaway’s pros and cons

- Chargeable fees

- StashAway vs other robo-advisors

- How StashAway’s returns compare with other investing strategies

- And whom StashAway is best for

How StashAway Works

Before going into the details, let’s first get to know how this platform works.

StashAway uses a trademarked algorithm to invest users’ funds into Exchange Traded Funds (ETFs) around the world. Since an ETF is a basket of securities, you get instant diversification from buying into a bundle of stocks instead of banking on a single stock.

StashAway also buys ETFs in a variety of sectors, which further diversifies your portfolio and lowers investment risk.

The algorithm factors in things like:

- Economic trends

- Individual risk profiles

- Your financial goals

when structuring your investments. Once it’s set up, it’ll automatically rebalance your portfolio as market conditions shift.

If you’re looking for an alternative to fixed deposits, StashAway Simple offers the option of a cash management account generating 1.2% per annum. There’s no minimum balance, no lock-up period, and no management fees.

Or if passive income is your thing, there’s the Income Portfolio Investment service: a Singapore-focused strategy to earn income from government and corporate bonds, real estate investment trusts (REITs), and dividend stocks with a minimum investment of S$10,000.

What you can do with StashAway:

- Invest in global ETFs

- Invest with cash or SRS funds

- Grow cash savings with StashAway Simple

- Invest for passive income with an Income Portfolio

- Get insurance coverage via StashAway Term Life

StashAway’s Pros and Cons

StashAway positions itself as a low-effort investment platform that even beginners can use. But is it as good as it claims to be? Here’s a quick look at the pros and cons:

Pros:

- No minimum sum, reasonable fees, and a straightforward app interface

- Easily builds an investment portfolio aligned to your goals and risk appetite

- Allows you to create multiple portfolios if you have more than one goal

- Easy diversification through ETFs

- Easy access to global markets

- Allows users to use SRS funds to invest, which also means tax deductions

Cons:

- No minimum sum, but there’s a management fee between 0.2% to 0.8% p.a.

- If you’re going for passive income, you need at least S$10,000 for the Income Portfolio

- Limited to ETFs — you can’t invest in any other asset classes

- The algorithm handles everything, so you can’t get hands-on exposure to trading and investing

StashAway Fees

You won’t pay for account opening, exit, withdrawals, or transfers, but you’ll pay an annual management fee of 0.2% to 0.8% per annum. This goes toward rebalancing costs, transaction fees, and re-optimisation costs.

The fees apply whether you’re doing general investing, goal-based investing, or investing for passive income.

| Total Investment (S$) | Annual fee (incl. GST) |

|---|---|

| First S$25,000 | 0.8% |

| Any additional amount above S$25,000, up to S$50,000 | 0.7% |

| Any additional amount above S$50,000, up to S$100,000 | 0.6% |

| Any additional amount above S$100,000, up to S$250,000 | 0.5% |

| Any additional amount above S$250,000, up to S$500,000 | 0.4% |

| Any additional amount above S$500,000, up to S$1,000,000 | 0.3% |

| Any additional amount above S$1,000,000 | 0.2% |

If you’re looking for a way out of these fees, StashAway does offer an interesting referral programme. For every friend you invite, both you and your friend will get a fee waiver for up to S$10,000 managed for six months.

There’s no limit to the number of friends you can invite, so you could technically stack the referrals.

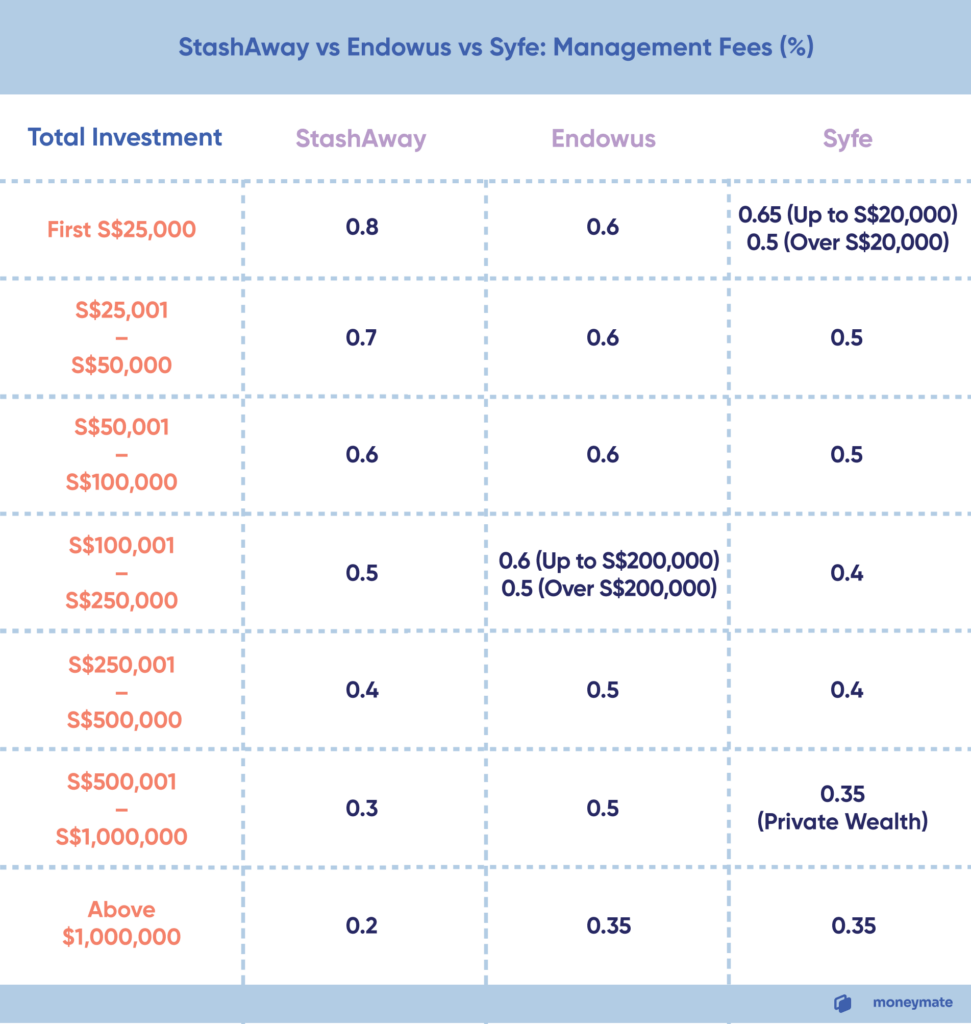

StashAway vs Other Robo-Advisors

Endowus and Syfe are two robo-advisors ranked closely to StashAway. Let’s look at how StashAway’s rates compare with theirs:

Endowus – Invest any less than S$200,000 and Endowus is cheaper than StashAway. But if you’re investing larger sums, StashAway is cheaper in the long run.

Just note that it’s hard to make direct comparisons here: unlike StashAway which trades only ETFs, Endowus invests more in funds or unit trusts. The underlying fees could differ greatly depending on the investor’s portfolio.

Syfe – Syfe’s rates are the lowest of the three robo-advisors just based on investment amounts less than S$250,000. This alone will win over a large pool of new investors only looking to invest in smaller amounts.

Again, it’s hard to make a direct comparison here because Syfe and StashAway offer different products. However, Syfe does have the upper hand as it offers a wider range of investment products including equities, REITs and bonds.

StashAway’s Returns vs Other Investing Strategies

StashAway’s main appeal is as a low-effort, beginner-friendly platform with decent returns. With that in mind, let’s look at how it compares with another popular low-effort investment strategy: dollar-cost averaging (DCA).

DCA with an ETF vs. StashAway: How Are the Returns?

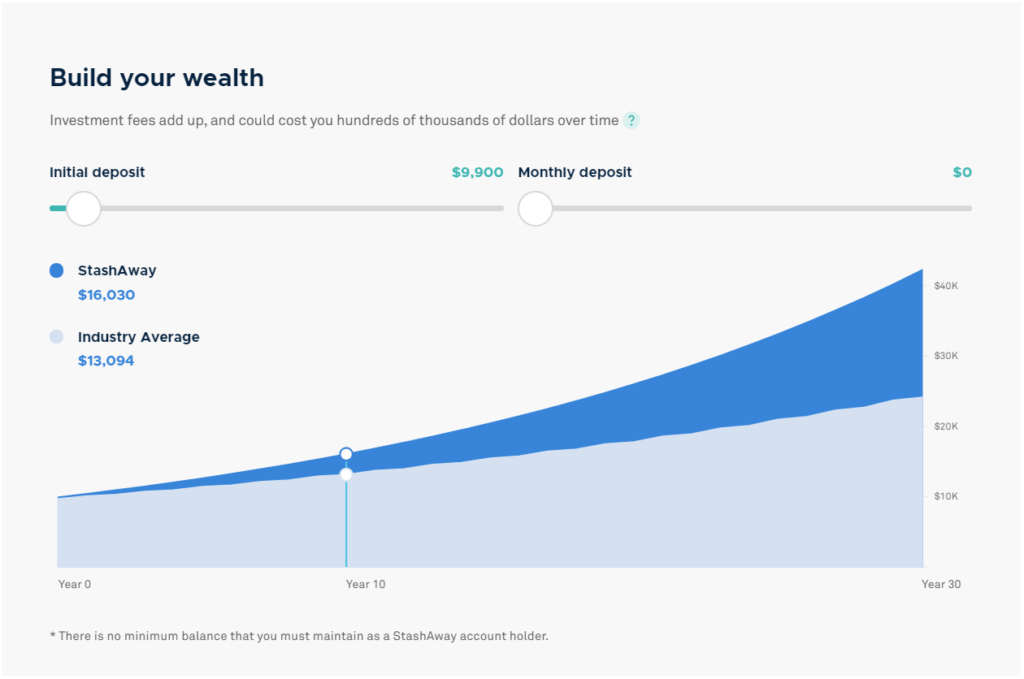

Visit the StashAway website and you’ll see an interactive chart depicting your possible returns:

According to the chart, an initial deposit of about $10,000 will turn into roughly $16,000 in 10 years — after deducting management fees, foreign exchange charges, and ETF expense ratios.

Dig a little deeper, however, and you’ll find that they’re assuming annual returns of 6%.

But wait: the S&P500 (one of the US market indices) has returned an average of 10.73% per year since 1991. That means that if you were to dollar-cost average into an ETF that tracks the index — like Vanguard’s S&P500 ETF (VOO) — you’d be getting higher returns for about the same level of effort.

You’d also be paying less in fees, since VOO has an expense ratio of 0.03%.

Granted, StashAway’s chart is just a projection: the actual returns you get using the app may be higher. And to make a fair comparison, you’ll also need to find a local brokerage that allows you to trade US ETFs with low or no commissions, not to mention favourable FX rates.

The Bottom Line: Whom StashAway is Best For

- New investors who want to trade global ETFs with the help of an algorithm

- Beginners who prefer robo-advisors over finding and managing their own brokerage accounts

- Individuals investing over S$500,000, as StashAway’s management fee is lower than other robo-advisors

On the other hand, StashAway is not a good fit for:

- Investors who love to explore an assortment of investment products like equities, bonds, REITs and funds

- Investors who enjoy the research and analysis and want more control over the assets they purchase

Read also: Best Investment Apps for Singapore