Pros

- Low management fees

- No minimum investment

- Customisable portfolios that align with your risk appetite

- Access to global markets

Cons

- Long time needed to see investment growth

- Relatively new robo-advisor

- No ability to invest CPF or SRS monies

- Initial learning curve may be steeper

Thanks to their auto-pilot nature, robo-advisors are becoming popular investment tools that allow even those with little investing knowledge to jump onboard. Syfe is one such tool.

With affordable fees and no minimum investment required, Syfe is an accessible option for beginners testing the waters.

Still, when putting your money in someone else’s hands, you always want to be sure you can trust the team to manage it well.

We’ll look into Syfe today, covering:

- What’s Syfe? How does it work?

- How does Syfe invest your money?

- Fees and minimums

- Syfe’s various portfolios and what to pick

- Syfe vs StashAway vs Endowus

- Whom Syfe is best for

What’s Syfe? How Does It Work?

First launched in 2019, Syfe is a robo-advisor that offers a variety of fully-managed investment portfolios with no minimum investment amounts or lock-in periods.

You don’t even need a brokerage account to begin investing with Syfe. Simply sign up with them, complete the ‘Getting Started’ survey, and you can begin growing your cash portfolio.

Client funds are held in a custodian account, which means Syfe can’t use your money for their own purposes. And in the (unlikely) event that Syfe goes bankrupt, your funds will be liquidated and returned to you in cash.

Syfe is regulated by the Monetary Authority of Singapore under a Capital Markets Services License.

How it works

As a robo-advisor, Syfe is one of the more hands-on platforms.

Like StashAway and Endowus, Syfe will have you fill out an initial questionnaire to get a sense of your risk appetite and goals.

But unlike StashAway, Syfe won’t automatically create your portfolio — rather, you’ll have to pick from the selection they offer you. That means having to learn about the differences between each portfolio and figuring out which one you want.

This is both good and bad. It’s good in that it gives you more leeway if you ever feel like you want to dig deeper into investing. You can even customise your own portfolio instead of choosing theirs.

But the initial learning curve is somewhat of a downside if you already find it challenging to get started with investing.

How Does Syfe Invest Your Money?

Once you’ve selected a Syfe portfolio (or customised your own), Syfe builds your portfolio and invests in Exchange-Traded Funds (ETFs) on your behalf.

Essentially, buying an ETF is like buying a bunch of stocks in a specific category — like real estate for example. This gives you a bit more diversification for your portfolio.

Fees and Minimum Amounts

One of the biggest perks with Syfe is that you don’t need a lot of money to start, which is great news for beginner investors. You can jump in even if you only have a small sum to start with.

That said, you do get different perks and lower fees the more you invest. Here’s a breakdown of Syfe’s four account tiers:

| Blue | Black | Gold | Private Wealth | |

|---|---|---|---|---|

| Management fee per year | 0.65% | 0.5% | 0.4% | 0.35% |

| Min sum of invested/value of investment portfolios | None | $ 20,000 | $ 100,000 | $ 500,000 |

| Benefits | Weekly Q&A with Wealth Experts | Access to Wealth Experts via scheduled calls | Access to a dedicated Wealth Expert | Access to non-retail investments and dedicated Wealth Expert |

Syfe’s management fee covers all your costs, from portfolio monitoring to automatic rebalancing. They’re relatively low at 0.65% for the basic Blue tier. While this isn’t the cheapest rate in the market, it’s still competitive.

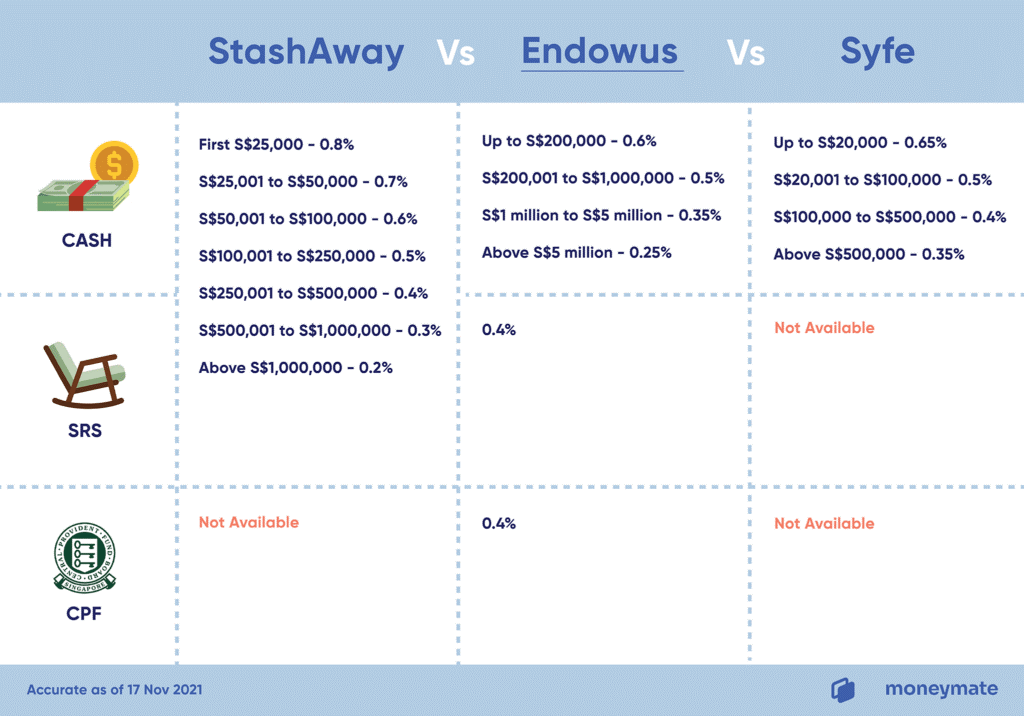

Here’s a quick look at the annual management fees for the most basic tiers of Syfe, StashAway, and Endowus:

| StashAway | Endowus | Syfe |

|---|---|---|

| 0.8% | 0.6% | 0.65% |

Compared to those of Endowus and StashAway, Syfe’s fees are the most competitive when you have between S$20,000 and S$500,000 with them.

The trade-off is that you can only invest cash with Syfe. StashAway allows you to invest cash and SRS funds, while Endowus allows you to invest cash, CPF, and SRS funds.

Syfe’s Various Portfolios and What to Pick

As previously mentioned, you’ll have to learn about the various Syfe portfolios when getting started on their platform. Ask yourself:

- What’s your investment timeframe?

- How comfortable are you with risk? Or in other words, how much of a loss can you tolerate? (e.g. 20%? 50? 90%?)

- What goal do you hope to achieve with investing?

Once you’ve got a better sense of your answers to those questions, you can choose from one of the available options:

| Core Portfolios | REITs | Cash Management | Syfe Select |

|---|---|---|---|

| Core Equity100 Core Defensive Core Balanced Core Growth | REIT+ (100%) REIT+ (Risk managed) | Cash+ | Themes (e.g. ESG, Disruptive Technology) Custom |

1. Core Equity100

As its name suggests, 100% of the Core Equity100’s funds are invested into global equities. This spans over 1,500 companies worldwide, including top stocks like Microsoft, Facebook, and Tencent.

You have no exposure to other asset classes like cash or fixed income.

The downside? Because there’s no diversification through bonds or commodities, you’re fully exposed to all the stock market movements. Expect higher volatility (possibly even a 90% drop in your portfolio) at times along with higher potential long-term returns.

Who is it for: Those who are willing to accept high risks in exchange for potentially higher returns in the stock market over the long term.

Investment time frame: Long-term (more than 5 years)

Investment allocation: 100% equities

2. Core Growth

Core Growth has the second highest risk level after Core Equity100. This portfolio invests in approximately 70% equities, 25% bonds, and 5% commodities (like gold).

Who is it for: Growth-oriented investors who are comfortable with moderately high levels of risk in exchange for potentially higher returns over the long run.

Investment time frame: Long-term (more than 5 years)

Investment allocation: Mostly stocks, with bonds and gold for stability.

3. Core Balanced

As its name suggests, the Core Balanced portfolio tries to achieve a balance between risk and returns. Its asset allocation is around 50% bonds, 40% equities, and 10% commodities.

Who is it for: Investors who are willing to take on some risk in the hope of higher returns but who largely want to protect their initial capital.

Investment time frame: Intermediate term (3-5 years)

Investment allocation: A balanced exposure in bonds and stocks plus some gold for stability.

4. Core Defensive

The Syfe Core Defensive has the lowest risk out of the four Core portfolios with an approximate asset allocation of 70% bonds, 20% equities, and 10% gold. With the lower-risk Core Defensive, your returns are stable and can better weather storms like pandemics and recessions.

Who is it for: Conservative investors looking for a low-risk portfolio that generates slow and steady returns.

Investment time frame: Short term (1-2 years)

Investment allocation: Primarily bonds and gold with some stocks for growth.

5. Syfe REIT+

Syfe REIT+ is Singapore’s first risk-managed Real Estate Investment Trust (REIT) portfolio. It holds a portfolio of the 20 largest REITs in Singapore, including well-known ones like CapitaLand Integrated Commercial Trust, Ascendas REIT, Mapletree Commercial Trust, and more.

Even if you’re not familiar with REITs, you’d probably know the properties they manage, like Vivocity and Changi Business Park.

With Syfe REIT+, you can choose to invest in 100% REITs (which only tracks the iEdge S-REIT 20 Index) or diversify your portfolio with REITs with Risk Management (which allocates part of your funds to Singapore Government Bonds). The latter reduces your risks but also potentially your returns.

Since the most reliable REITs have a track record for paying large and growing dividends, the main draw of Syfe REIT+ is the dividend payout. By default, all dividends are automatically reinvested. You can choose to receive payouts every quarter if you’re in the Black tier (S$20,000) or above, however.

Who is it for: Investors looking to earn passive income.

Investment time frame: Long-term (more than 5 years)

Investment allocation: Real Estate Investment Trusts (REITs) and some government bonds.

6. Syfe Cash+

Syfe Cash+ is a cash management account. It functions somewhat like a savings account but with variable and non-guaranteed returns.

With Syfe Cash+ you can potentially earn higher projected returns (1.2% p.a) than a typical savings account. You’re also free to withdraw your money anytime.

Just keep in mind that unlike a regular savings account, neither your returns nor your capital is guaranteed. You might earn up to 1.2% p.a., as Syfe claims, but you can also lose money.

Who is it for: Those who want to grow their spare cash.

Investment time frame: One month+

Investment allocation: Low-risk money market funds and short duration bond funds.

7. Syfe Select (Themes & Custom)

If you don’t want to invest in ready-made portfolios, Syfe lets you assemble your own from a curated list of over 100 best-in-class ETFs. Choose from 5 thematic portfolios (ESG, Disruptive Tech, Healthcare Innovation, China Growth, Global income) via Syfe Select Themes or assemble your portfolio by selecting up to eight ETFs via Syfe Select Custom.

Syfe vs. StashAway vs. Endowus

Syfe, Endowus, and StashAway are popular robo-advisors in the local market. Even though they specialise in different assets, their target markets are similar. Here’s an overview of the three:

| Syfe | StashAway | Endowus | |

|---|---|---|---|

| Min. Investment | None | None (except for Income Portfolio) | $1,000 |

| Source of Capital | Cash only | Cash, SRS | Cash, SRS, CPF |

| Asset Types | REITs, ETFs, Equities | ETFs | Mutual Funds, Unit Trusts |

Below, you’ll see a comparison of the management fees for all three platforms. Notice that Syfe’s fees are generally lower than those of StashAway and Endowus, especially between S$20,000 and S$500,000:

| Total Investment | Syfe | StashAway | Endowus |

|---|---|---|---|

| First $25,000 | Up to $20,000: 0.65% $20,000 – $25,000: 0.5% | 0.8% | 0.6% |

| >$25,000 to $50,000 | 0.5% | 0.7% | 0.6% |

| >$50,000 to $100,000 | 0.5% | 0.6% | 0.6% |

| >$100,000 to $250,000 | 0.4% | 0.5% | Up to $200,000: 0.6% Above $200,000: 0.5% |

| >$250,000 to $500,000 | 0.4% | 0.4% | 0.5% |

| >$500,000 to $1million | 0.35% | 0.3% | 0.5% |

Overall, Syfe offers a broader range of products (REITs, ETFs, and equities) to appeal to investors who want more diversification and involvement with their portfolio.

Syfe also offers the lowest fees for portfolios up to $500,000 and requires no minimum investment amount.

Whom is Syfe Best for?

- Beginners who prefer getting risk-managed portfolios instead of actively trading stocks on their own

- Investors who want to diversify or explore an assortment of investment vehicles

- Investors who wish to explore local REITs

- Investors with limited funds (less than $1,000)

- Beginners who want the leeway to get more involved in portfolio management in future

Syfe is not suitable for:

- Investors who want to maximise their CPF and SRS funds

- Beginners who’d prefer an easier learning curve at the start