Many people are currently raving about how the economy is rebounding and that it’s a great time to invest.

As a student, you might be wondering how to start when you don’t have much money to invest even with a part-time job.

We all know that compound interest works wonders. Starting as early as possible will help you build financial independence so you’re not bound to a job you hate.

Today, we’ll guide you through how to start investing with little capital, step by step:

- Know Your Risk Profile

- Figure Out How Hands-on You Want to Be

- Determine Your Starting Amount

- Choose the Right Broker

- Identify an Appropriate Investment Strategy

- Stay Educated About the Market

Step 1: Know How Much Risk You’re Willing to Take On

Investors tend to consider two factors when determining how much risk they’re willing to take: time horizon and the maximum loss.

1. Time Horizon

This refers to how long you can afford to keep your money in the markets without withdrawing. For example, you may be looking to invest a certain amount of money and withdraw it at the end of university to pay off your tuition fee loan. This gives you a time horizon of roughly 3-4 years if you’ve just finished your tertiary education.

With shorter time horizons, higher risk strategies like stock picking aren’t recommended. These are volatile, so you may be forced to sell your securities at a significant loss when you need the money urgently.

Longer time horizons means you have more of a runway to withstand the volatility and recoup potential losses. That means you can take on greater risk.

2. Maximum Amount You Can Stand to Lose

As a rule, invest only funds you can afford to lose or have tied up for a period of time.

This ensures that you won’t be pressured to sell off any investments in a flurry of panic or cash crunch. The more of a buffer you have, the greater the risks you can withstand.

Once you understand your own risk profile, you’ll be better able to allocate your assets and diversify your portfolio accordingly.

Step 2: Figure Out How Hands-On You Want to Be

Do you want to approach investing with a more “hands on” or “hands off” approach? This will affect the methods you use to invest.

An active investor puts a lot more time and analysis into investing. They’ll look through the markets and take their time to analyse prospects before deciding to invest. This takes a lot of learning upfront and requires expertise in the equity markets, how to evaluate a business, a fund’s portfolio, and so on.

As an active investor, you’ll be saving money as you won’t be paying management fees. But as an inexperienced investor, you might also make mistakes and lose money.

Most students choose passive investing instead, as having to manage studying and working part-time is already draining. Add on reading financial statements, managing an investment portfolio, and keeping up with the news and it may all be too much to handle.

Passive investing is easy with the help of robo-advisors: they’ll handle the analysis and portfolio management for you. All you need to do is fund the account and set up your initial investor profile.

Read also: Best Investment Apps for Singapore

Step 3: Determine Your Starting Capital

A general rule of thumb is to invest only after you’ve accumulated at least six months’ worth of expenses in savings. This ensures that you’ll have something to fall back on and won’t have to draw on your investment capital in an emergency.

Once you’ve done that, it’s time to determine how much you should invest.

If you can afford it, a good gauge would be 20-30% of your paycheck or allowance. This may not be a large amount, but now there are brokerages that allow you to invest with as little as $50/month.

As students, we don’t have large savings or earnings to support huge investments. However, the advantage we have is the early head start compared to seasoned investors. Even if we can only invest a little every month, the power of compound interest can grow a sizable portfolio.

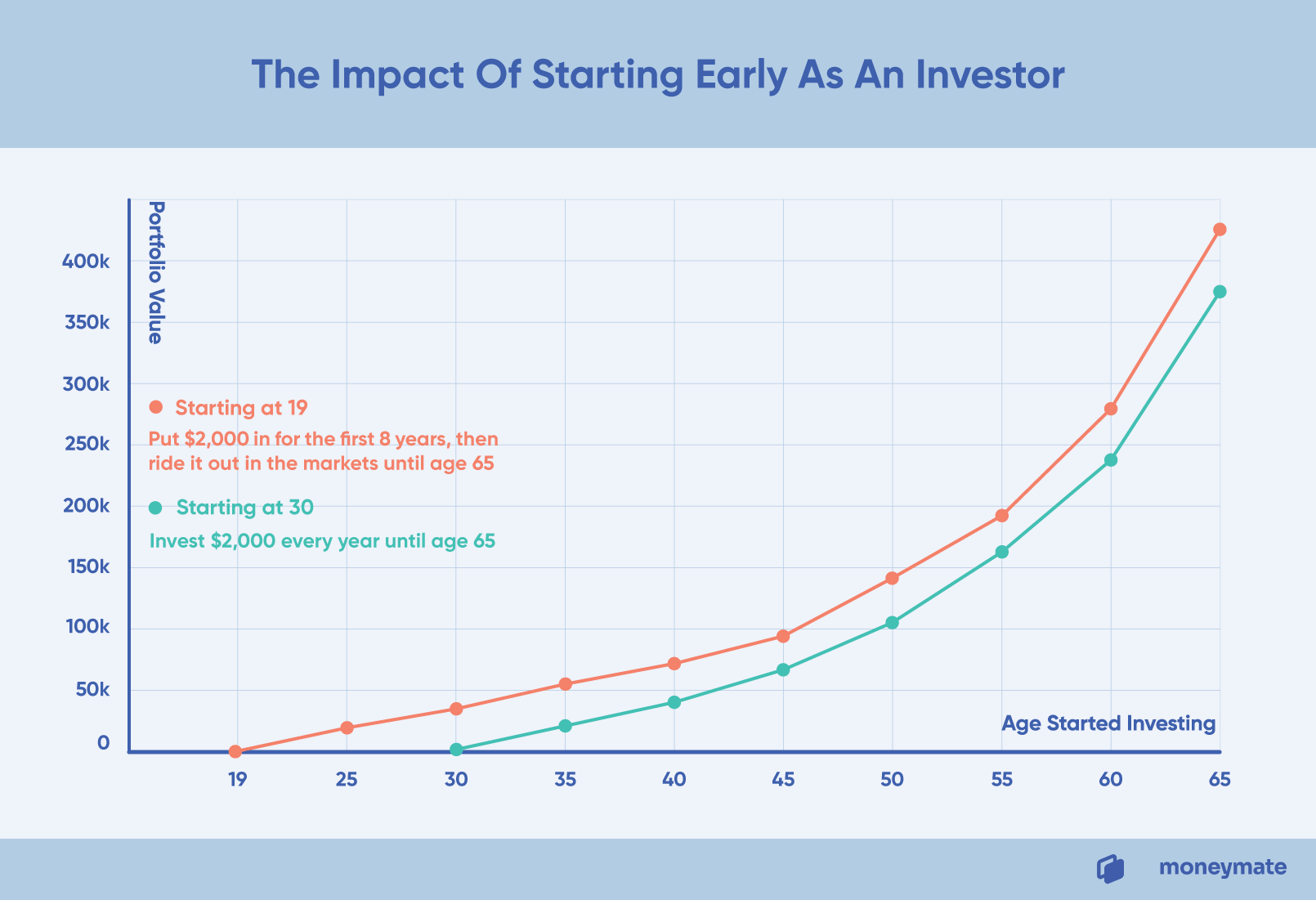

Consider two scenarios:

- A 19-year old starts investing $2,000 a year (or about $167 a month) for the first eight years. Afterwards, he lets his investment portfolio compound with the average annual returns of 8%.

- A 30-year old starts investing $2,000 a year — every year until he turns 65.

Which one do you think had the larger portfolio at the end? Check out this graph for the answer:

Even though the 19-year-old student only actively put in cash for the first eight years, he still wound up with a good 50k more than the guy who put in money for 35 years. That’s the magic of compounding.

4. Choose the Right Broker

When you have limited capital, you’ll want to pay attention to the management and platform fees you may incur. Choosing the right low-commission platform to invest on makes a huge difference.

Here are some of our recommendations for:

Local Brokerages

Best suited for investors who value a local name, invest in mainly Singapore stocks, or who prefer to use integrated services (i.e. investing and banking with the same institution):

- FSMOne

- DBS Vickers

- UOB Kay Hian

Overseas Brokerages with a Local Presence

Best suited for investors wanting the cheapest commissions or investing mainly in overseas stocks:

Mobile Brokerages

Best suited for investors who value on-the-go access to their accounts:

- MooMoo

- Tiger Trade

- SaxoTraderGo

Robo-advisor Apps

Best suited for investors who want to put in minimal effort for decent returns:

Take your time to try out the demo versions of each brokerage platform. Being familiar with the user interface and checking out the resources available will greatly aid your investing journey later on. Try not to mix many trading apps at once as it will be challenging to monitor multiple portfolios simultaneously.

5. Identify an Appropriate Investment Strategy

As a quick overview, here are possible asset classes you can invest in:

Index Funds vs Individual Stocks

An index fund is a portfolio of assets held and managed by an investment firm. Here, you’re putting money into a basket of stocks. You own a percentage of the overall portfolio and are entitled to the fund’s returns on a pro-rated basis.

In contrast, purchasing individual stocks is similar to placing a (calculated) bet on a single company’s growth potential and performance.

Investing in index funds is a better method when you have little capital because:

- You don’t need to pick stocks yourself (safer option).

- You’ll get a diversified portfolio with decent returns.

Stocks vs Bonds

Purchasing a company’s stock entitles you to partial ownership in a corporation. Bonds, however, are like you lending cash to a business. The main difference is in how you profit.

To profit from a stock purchase, you’ll need to sell the stock at a price higher than what you paid. With bonds, you earn from the fixed interest payments after you’ve kept the bond for the full duration.

Both stocks and bonds require a larger upfront investment, which may not be the best option for students. It’s also difficult to sell them for a profit if you’re facing a time crunch.

6. Stay Educated About the Market

It’s okay if you’re afraid to take the leap into investing: for most of us, financial education wasn’t part of our formal schooling. That’s why it’s important to educate ourselves about investing and try out trading simulators before we risk our money.

Your investing journey will require lots of trial and error on top of constant learning. But you’re not alone: there are tons of resources and young investor programs out there.

Trading simulators you can use to test the waters:

- Saxo Markets Demo Account

- OANDA Demo Trading account

- Moomoo Demo Account (only supports paper trade on mobile)

Educational resources you may want to check out:

There is no one-size-fits-all solution when it comes to investing. Take your time and find your own investment style as you read up on the markets. The longer your investment horizon, the more wealth you can accumulate, and the lower the overall risks to your portfolio. That’s why it’s best to start early regardless of how little you can invest as a student.

Read also: 5 Investment Tips for Beginners in Singapore