Pros

- Assets stored in custodian account under client’s own name

- Low, flat fee for smaller portfolios

- Access to personal wealth manager

- Option to set up monthly/quarterly investment plan

Cons

- High $3,000 minimum investment

- Flat fee structure means higher costs for large portfolios

- Cannot invest CPF or SRS funds

- No option to customise your own portfolio

Finally decided to dive into stocks? If you’re a beginner, you’ll need all the help you can get — it’s a complicated world you’re about to enter.

Fret not though: with robo-advisors like AutoWealth, you’ll get low-cost managed portfolios with automatic rebalancing and less of a learning curve. These platforms use algorithms to pick investments for clients, simplifying the entire process for the layman (or the busy professional). All you have to do is figure out your risk appetite.

Today, we’ll review AutoWealth and cover:

- What AutoWealth is and how it works

- Eligibility

- Fees and minimum investment amounts

- What’s good about AutoWealth?

- AutoWealth vs Syfe vs StashAway vs Endowus

- Who should use AutoWealth

What is AutoWealth and How Does It Work?

AutoWealth is a regional robo-advisor launched in 2015 by Singapore-based Ow Tai Zhi, a former GIC investment banker. It’s a Licensed Financial Adviser certified by MAS.

As with other robo-advisors, the premise of AutoWealth is that active fund managers usually underperform the market — so it’s better to grow your funds with the market in general rather than try picking individual stocks.

The algorithm automatically selects, builds, and rebalances portfolios so there’s minimal effort required from you.

How Does AutoWealth Choose What to Buy?

AutoWealth adopts a straightforward passive market-tracking investment strategy.

The algorithm diversifies its client portfolios across four major geographical regions (US, Europe, APAC, and Emerging Markets) and all major industries through index-tracking Exchange-Traded Funds (ETFs). This results in more defensive portfolios (i.e. fewer gut-wrenching price drops) in times of market turmoil.

With this, investors can expect their returns to approximate the general market returns of global stocks and government bonds.

Eligibility: Who Can Invest with AutoWealth?

AutoWealth is open to all Singaporeans and foreigners residing in Singapore and overseas, except for US citizens, US residents, and China residents.

Fees and Minimum Investment

AutoWealth requires a $3,000 initial deposit. While this may sound steep compared to other robo-advisors, the higher-than-average minimum sum is so each client has a personal custodian account. (More on that below.)

Subsequent top-ups have no minimum requirements.

Read also: 10 Best Investment Apps for Singapore in 2022

Management and Platform Fees

AutoWealth charges a flat management fee of 0.50% plus a platform fee of US$18 each year. Unlike the tiered fee structure most robo-advisors use, AutoWealth uses a fixed fee structure.

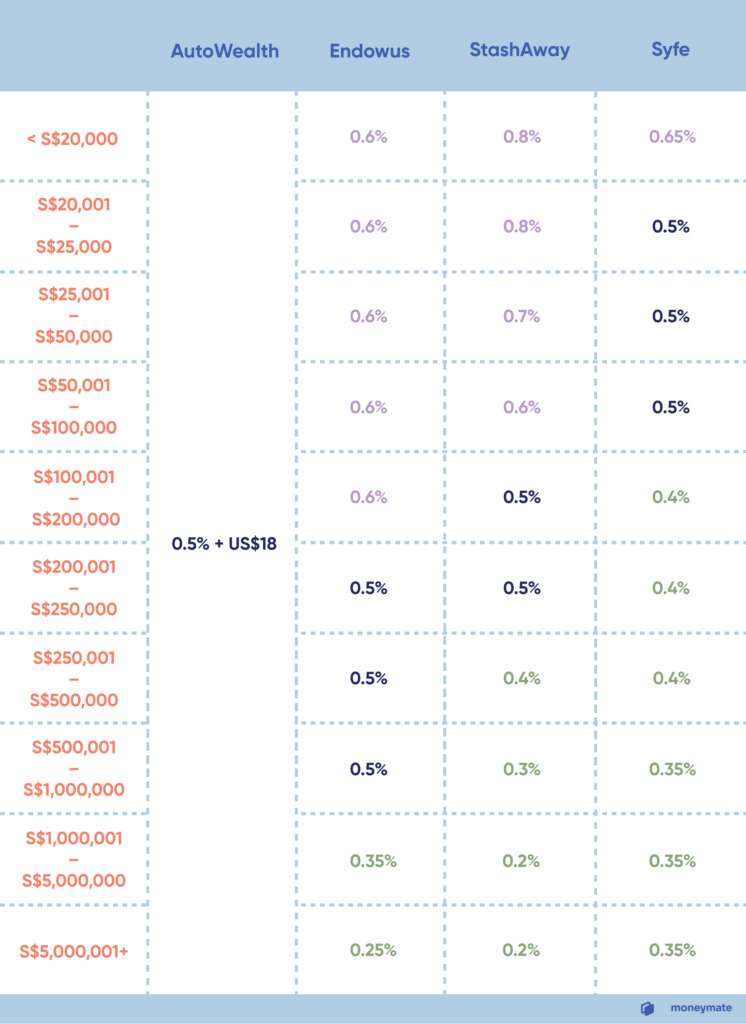

This is great if you have a smaller portfolio (under S$100,000), but not so great if your portfolio is above S$250,000. If it’s the latter, alternatives like Syfe and StashAway offer better rates:

Fees shouldn’t be your only consideration, however. We’ll elaborate on that in the comparison of AutoWealth vs Syfe vs StashAway vs Endowus below.

What’s Good About AutoWealth?

Personal Custodian Account

The biggest draw of AutoWealth is that your assets are held in a custodian account under your name and they legally belong to you. In the event of a dispute or the collapse of the platform, you still get full say over what happens to those assets.

Personal Wealth Manager

All investors are assigned a wealth manager whom AutoWealth claims “is just one WhatsApp away.” Your wealth manager doesn’t actively manage your portfolio though (the algorithm does that). Instead, he or she answers questions and assists clients, making it a good fit for those seeking a more human touch.

Financial Advisory Projection

You can plan how much you need to invest to reach your goals via their advisory projection module, all without creating an account. Even if you don’t intend to use AutoWealth, this is a handy tool for financial planning.

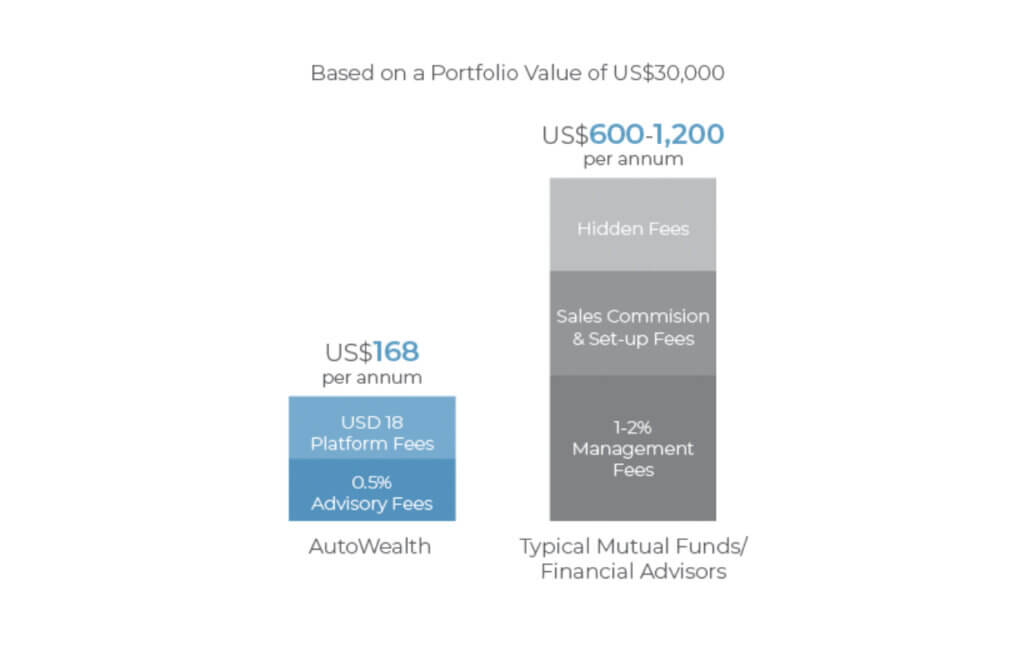

Low Management Fees

AutoWealth has a simple, non-tiered fee structure: 0.5% advisory fee and a flat platform fee of US$18 per year. There are no extra charges for buying, selling, withdrawals, and rebalancing even though such charges are common.

Low fees are critical to any robo-advisor proposition, since traditional fund managers can charge as high as 2% in management fees:

Recurring Investment Plan

This is common with robo-advisors nowadays, but it’s worth noting that AutoWealth clients can also set up a recurring monthly or quarterly investment plan. This is similar to a Regular Savings Plan.

Read also: A Beginner’s Guide to Regular Savings Plans in Singapore

AutoWealth vs Syfe vs StashAway vs Endowus

| AutoWealth | Syfe | StashAway | Endowus | |

|---|---|---|---|---|

| Asset | ETFs | ETFs | ETFs | Funds |

| Annual Fees | 0.5% + US$18 platform fee | 0.65% for investments less than $20,000 | 0.8% for the first $25,000 | 0.60% for first $200,000 0.40% flat fee for CPF or SRS funds invested |

| Min. Investment | $3,000 | None | None (but min. $10,000 for Income Portfolio) | $1,000 |

| Funding Source | Cash | Cash | Cash, SRS | Cash, CPF, SRS |

Highest Minimum Investment Requirement

At S$3,000 minimum initial deposit, AutoWealth is not for those with limited starting capital. Syfe and StashAway are the most accessible options in that regard.

Lack of CPF and SRS Funding Options

AutoWealth does not have CPF or SRS funding options just yet. Endowus wins hands down in this category since you can invest with cash, CPF, or SRS funds.

Personal Custodian Account

Most robo-advisors — like Syfe and StashAway — pool together their client funds in an omnibus custodian account. The main perk of this is that it allows clients to buy fractional shares (i.e. part of one share) even if they don’t have enough cash.

Things get complicated if the platform shuts down though. You’ll get your money back (eventually), but the legal ownership of each asset is unclear — so in the chaos, you might not get much of a say and the custodian bank may liquidate your assets at a loss.

AutoWealth and Endowus, on the other hand, segregate client funds in a custodian account under the client’s own name.

With a personal custodian account, you don’t get to purchase fractional units of ETFs, but the assets legally belong to you. You have full say over how and when to dispose of the assets (if you wish to) instead of being forced to sell at a loss.

This is also why there is a minimum of $3,000 before we can open a portfolio with AutoWealth.

Who Should Use AutoWealth

Overall, AutoWealth has its merits if you’re looking to grow a small to moderately-sized portfolio. It’s also one of the few robo-advisors in Singapore that offers personal custodian accounts.

We’d recommend AutoWealth if you:

- Want the added safety of a custodian account under your own name

- Have at least S$3,000 in cash to invest

- Plan to grow your cash portfolio but keep it under S$1,000,000