You’ve probably heard that Singapore has an ageing population.

But if you’re nowhere near retirement age, it may not have registered as a blip on the radar — let alone something to factor into major life decisions.

But we’re already starting to see the effects.

Shop for a new home now and you’ll come across a few units with extra-large “wheelchair-friendly” bathrooms (at the expense of other living spaces). This isn’t just about accessibility: Singapore’s builders are preparing for our increasing numbers of elderly.

So what does an ageing population mean for working-age residents? We’ll explore the reasons, consequences, and solutions today.

Ageing Population Problems: What It Means for Younger Generations

With an ageing population, the ratio of elderly to working-age citizens shifts. Over time, there will be fewer working-age citizens for every person over the age of 60.

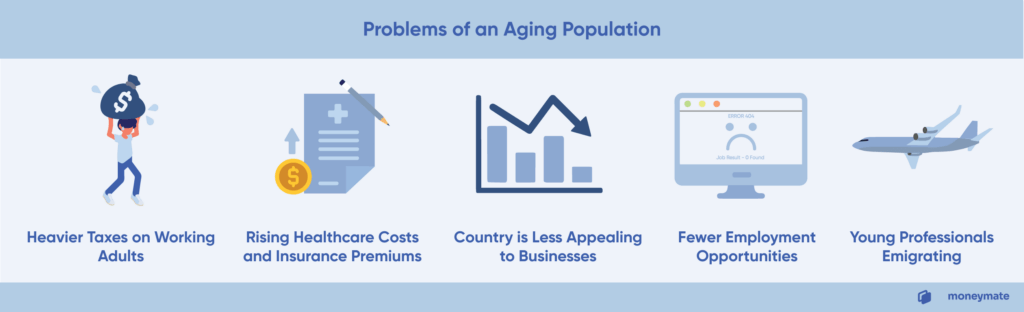

This has several knock-on effects, such as:

- Fewer people paying taxes and more people withdrawing government-backed pensions, leading to a greater tax burden on working-age citizens

- Increasing healthcare costs and insurance premiums to cover the costs of chronic illnesses that come with age

- Lower overall productivity and innovation, making the country less appealing to businesses

- A lack of attractive employment opportunities for young professionals

- Young citizens leaving the country for better opportunities, further compounding the labour shortage and tax burden

Let’s look at a few examples of how this has played out across Asia.

Japan

Japan now ranks among one of the oldest populations in the world (Source). More than a quarter of the population are citizens over the age of 65.

It also has the highest income tax rates in Asia, topping out at 55% compared with Singapore’s top income tax bracket of 20%.

This is partly because of Japan’s reputation for manufacturing quality products: there are many highly paid executives in Japanese multinational corporations. These residents shoulder more of the load in taxes, which then go into building out public infrastructure.

But these high-paying positions mostly go to older, more seasoned executives.

Younger employees live in a much harsher reality: they face increased pressure to be productive despite the lack of wage increases and working opportunities in Japan’s slowing economy. Even if you earn a more modest amount, you’ll still pay high income taxes as a resident of Japan.

Hong Kong

In 2021, there were 227 elderly citizens for every 1,000 working-age citizens in Hong Kong. The WHO estimates that by 2050, 40% of Hong Kong’s population will be 65 or above.

Since older individuals are more fiscally conservative, Hong Kong’s economy will likely slow down.

Meanwhile, property prices are continuing to increase. The prospect of owning their own homes is slipping further away from the reach of Hong Kong’s young professionals.

China

As China’s territory spans a vast geographical area, you’ll see a mixed bag of statistics.

On the one hand, China’s population is ageing faster than the worldwide average (Source).

On the other hand, almost 40% of China’s population is still rural. This is where most of the population growth occurs (read: city life is more stressful and less conducive for baby-making).

This has led to fierce competition for jobs in cities along with higher taxes: China stands as #3 on our list of highest income tax countries in Asia.

Singapore

Singapore has fared well even with its rapidly ageing population. It’s deliberately set itself up to be attractive to multinational corporations with its political stability and low corporate tax rates. And while it doesn’t boast zero income tax like oil-funded Gulf nations, it has pretty low income taxes.

But it certainly isn’t immune to problems. For one, technological advancements mean that companies are replacing employees with automation. Workers are forced to reskill quickly if they want to remain relevant, but not all manage to do so.

Secondly, the rising costs of living and higher healthcare costs means there’s a significant burden on the ‘sandwich class’ — the children who are supporting their elderly parents.

Sadly, not all elderly citizens have someone to care for them. This partially explains why suicide rates among the elderly are also the highest across all age groups.

Read also: The Top 10 Asian Countries With the Oldest Populations

Ageing Population Causes: How Did We Get Here?

There are three main reasons for an ageing population:

- Lower Fertility Rate: People are having fewer children or delaying the age they have children.

- Increasing Longevity: Advancements in medicine means we now live longer.

- Emigration: Difficulty in finding work means younger professionals are forced to emigrate for better opportunities.

Ageing Population Solutions

An ageing population does present challenges for younger citizens, but it isn’t all bad. Here’s our advice for working-age citizens:

1. Invest in Technology

Labour shortages means pressure on both employers and employees. Companies must figure out how to get more productivity with fewer resources. Instead of waiting for parts of your job to be replaced by machines, take the initiative to learn about AI and automation.

If you’re a salaried employee, consider any repetitive tasks you may have to do at work. Are there ways you could automate these? This allows you to achieve the same results more quickly and frees up your attention for higher-value tasks.

For example, you can optimise certain accounting tasks with the help of recorded macros in Excel. And there’s now a ton of automation software to optimise many marketing and sales functions.

If you’ve got an entrepreneurial bent, consider ways you could take advantage of ageing population trends in business planning. Japan, for instance, is now investing into medtech and building care robots and mechanical caregiver aids. Not only does this meet the needs of their large elderly population, but it may also be a new growth industry for the nation.

2. Embrace Lifelong Learning

You may have heard certain industries being referred to as “iron rice bowls” (i.e. job security that will provide for you for life). But in today’s fast-changing working landscape, this no longer holds true.

Always keep a lookout for how your industry may be shifting, then proactively upskill yourself so you’re well-positioned for the change.

Be sure to take advantage of government subsidies to upskill, such as SkillsFuture’s work-study programmes and course credit.

3. Plan for the Future

Because of the rising costs of living, we now have a significant elderly population that must continue to work through their 60’s.

But even if you’re younger, inflation is still cause for concern.

Governments around the world poured trillions in economic stimulus into the market when the pandemic hit. While the Monetary Authority of Singapore only recorded a 2.1% CPI inflation rate in April, we’ve seen the inflationary effects of the stimulus elsewhere.

Singapore property prices have gone up about 2-3% every quarter, for instance. Equity-wise, the S&P 500 is also about 25% above its pre-pandemic highs.

Asset prices are rising quickly, and we must plan our financial futures accordingly.

Prepare Yourself

Simply moving to a different country may not be the best option, given that the global population as a whole is rapidly aging. Even the most promising countries have their own fair share of problems.

Singapore has done a great deal to prepare its citizens for an ageing population, implementing schemes such as CPF LIFE and government-subsidised reskilling programmes.

The World Economic Forum even cited Singapore as an example of a country that’s “most prepared to deal with ageing populations.”

So let’s play our part as well.