“I have to pay taxes in two countries?!”

As an American living in a foreign country, that was my reaction the first time I had to file my taxes.

Maybe you’re one of the lucky ones who escaped this fate…or maybe you’re just wondering if there are tax havens you can move to that will allow you to keep more — or all — of your income.

We’ll cover the lowest income tax countries in Asia (and also those with the highest taxes), touching on aspects like:

- Whether the taxes are on worldwide or locally-sourced income

- Personal income tax rates, assuming you’re middle-class and not stashing away your fortune in some untouchable offshore bank account

- Capital gains taxes (so you can keep income from your investments if any)

- Repatriated income (in case you have income from your home country)

Read also: What Kind of Taxes Does Singapore Impose on Expats?

Basic Assumptions and Definitions

Where income tax applies, we’ll assume that you bring in US$7,000 every month (or US$84,000 per year) as a single for our calculations.

Progressive Tax Systems

Most countries have this. It means the more income you earn, the higher the percentage you pay in taxes. $7,000 monthly sits in the middle: it’s neither very high nor very low and a reasonable salary for a university-educated professional who’s been working for 10 years. (This changes depending the country you live in, though!)

Tax Resident

Tax residency laws vary, but in general being a tax resident of a country means you’ve lived there for at least 183 days in the past year. You may not be a citizen, but for the most part you’ve chosen that country as your home base. For the purposes of our calculations, we’ll assume you’re a tax resident.

Repatriated Income

Say you live in one country but have business dealings in another. Repatriated income is when you bring that foreign income back to your home base.

Capital Gains Taxes

Capital gains refer to the profit you get (if any) when you sell off assets such as stocks or property. If you hold investments in various countries, we’ll check whether you’re taxed on the capital gains.

Asia vs ASEAN Personal Tax Rates

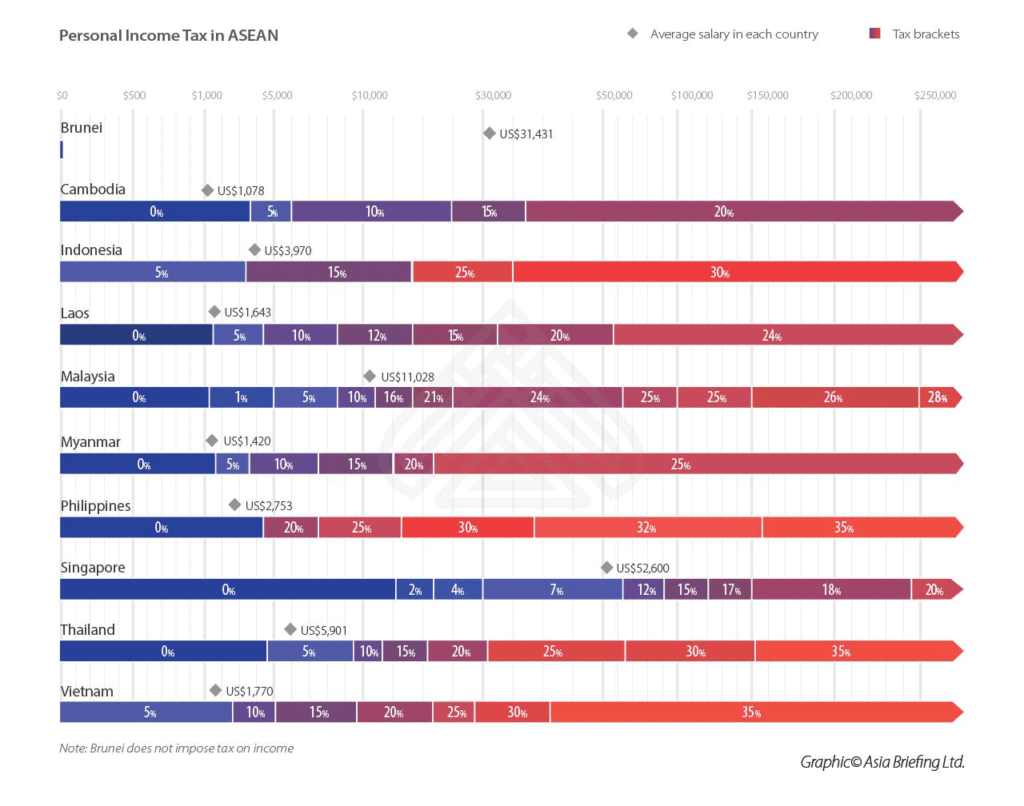

Before we jump into the Asian countries with the lowest personal income taxes, check out this chart depicting the tax rates for ASEAN countries:

A few things stand out with ASEAN countries:

- Brunei does not have personal income taxes.

- Vietnam, Thailand, and the Philippines have the highest income tax rates for top earners.

- Singapore has the lowest income tax rates for low to mid-range earners.

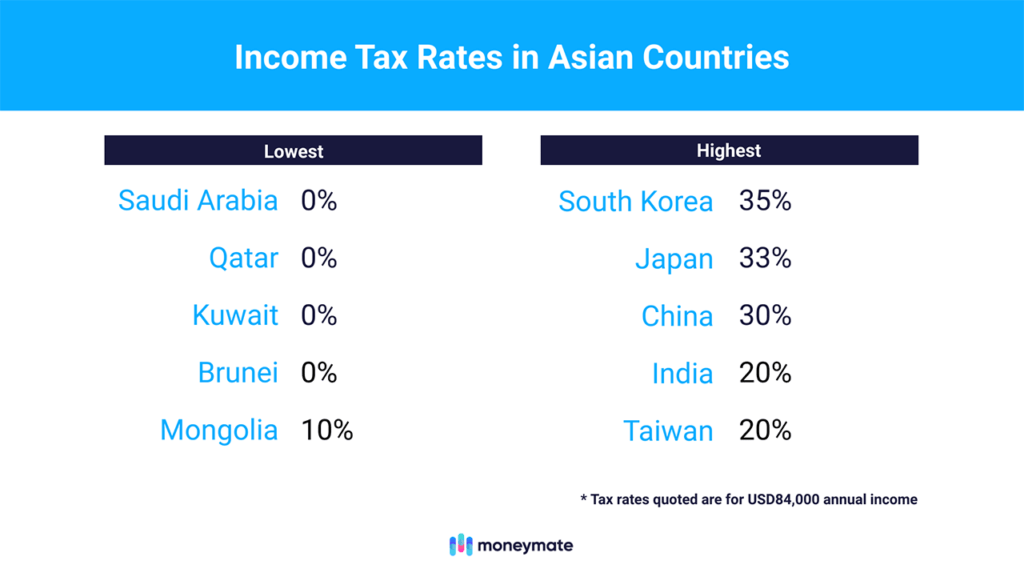

Now let’s expand our range and look at Asia as a region.

Asian Countries With the Lowest Income Taxes

1. Saudi Arabia

- Income tax: No

- Capital gains taxes: No, unless derived as a self-employed individual

- Taxes on repatriated income: No

Rich in natural resources, Saudi Arabia derives its wealth from crude oil production and petroleum refining rather than taxes. The standard of living is high while cost of living is low — education and healthcare are free, for example. Saudis also enjoy relatively inexpensive utilities and food.

But because the country is so dependent on oil exports, crashing oil prices have forced them to revisit their policies. Since July 2020 for example, residents have had to pay a 15% Value-Added Tax (VAT) on almost all goods and services.

The country is now moving to reduce their reliance on oil, but it remains to be seen if it’ll succeed.

2. Qatar

- Income tax: No

- Capital gains taxes: No, unless derived as a self-employed individual

- Taxes on repatriated income: No

Like Saudi Arabia, Qatar is rich in natural resources. It rose out of relative poverty to become one of the world’s richest countries through its oil and natural gas exports.

That said, the country’s dependence on oil and gas has also led to systemic inequalities.

95% of its labour force are made up of migrants, while a majority of Qatar’s resident population are expats. The most wealthy are expats who moved to the country to become C-suite executives for multinational corporations.

In contrast, migrants have little to no labour rights in the country, leading to widespread poverty and exploitation. Hundreds of thousands live in labour camps where disease is rampant.

In 2020, Qatari authorities passed two laws in an effort to raise the living standards of migrant workers. But given the pandemic’s impact on unemployment rates, it will still take quite a bit more follow-through to reduce the inequality in the country.

3. Kuwait

- Income tax: No

- Capital gains taxes: No

- Taxes on repatriated income: No

Although there’s no income tax in Kuwait, Kuwaiti employees contribute 8% of their salary to social security. Employers contribute another 11.5%. This social security fund covers retirement pensions and allowances for disability, sickness, and death.

Like most countries along the Persian Gulf, the benefits in Kuwait are great. Education and healthcare are free. The cost of living is low but standard of living is high. Kuwait is a relatively safe place to live in as well.

Similar to Qatar, there’s a huge expat population in Kuwait. In recent years, the government has been moving to reduce the expat population by lowering or cutting benefits, increasing costs, and making it more difficult to acquire or renew visas.

4. Brunei

- Income tax: No

- Capital gains taxes: No

- Taxes on repatriated income: No

Brunei is a tiny country that also depends a lot on its oil and gas production. The sovereign state is too small for there to be much else economically, and the majority of the workforce are civil servants.

That said, Brunei has other perks to attract expats: a safe environment, clean air, close proximity to unspoiled nature, and good schools.

As with the top three countries in this list, Brunei is a Muslim state and is therefore more culturally conservative. Alcohol is scarce, and activities like sunbathing at the beach are basically non-existent because of the emphasis on modest dressing.

But unlike the abovementioned countries, Brunei’s expat population is the minority. Foreigners living in the country mainly gather among themselves — interactions with local Bruneians are through work and school.

5. Mongolia

- Income tax: 10% on worldwide income

- Capital gains taxes: Taxed as part of annual income

- Taxes on repatriated income: Yes

Most expats choose Mongolia not because it’s a great place to make money or advance their careers, but because they love the country itself. Many have settled here because they’re in relationships with locals.

Although 70% of Mongolia’s population lives in urban centres, the country still has strong ties to its heritage as a nomadic herding culture. City life is modern, but you won’t find a wide variety of food, medicine, and imported products you can buy.

Mongolia’s economy is reliant on international investments. This means it’s vulnerable to price fluctuations, such as when the prices of precious metals dropped. Afterwards, high-paying jobs also dried up.

Asian Countries With the Highest Income Taxes

Four out of five countries with the lowest income taxes are along the Gulf. They also share a similarly conservative culture and public welfare benefits.

But while income tax is a pain, the same countries that tax heavily also often provide other benefits in return. So let’s look at five of the countries on the other side of the spectrum:

1. South Korea

- Income tax: 35% (on annual income of 93,761,640 won, or USD84,000)

- Capital gains taxes: Yes, with certain exemptions

- Taxes on repatriated income: Yes, if you’ve stayed there for more than five years

South Korea is a bit like Thailand in that it can accommodate a wide range of wallets.

If you’re okay with forgoing creature comforts, you can get meals for under a dollar and rent a goshiwon (flexible student housing) for USD210 a month. On the other hand, you can also dine at a classy restaurant for USD150 per person and rent a studio apartment for $1,000-2,600 a month.

If you’ve lived in South Korea for over five years, you’re subject to a worldwide progressive tax system. Lower brackets aren’t taxed much (though still comparatively higher than, say, Singapore), while the highest earners pay up to 45% in income tax.

Much of these funds go toward infrastructure and healthcare. South Korea has one of the best-connected and fastest internet networks in the world. Public transportation is easily accessible and well-maintained. Healthcare in South Korea is also one of the best in the world, with the country becoming a hotspot for medical tourism.

2. Japan

- Income tax: 33% (on annual income of 9,251,886 yen, or USD84,000)

- Capital gains taxes: Yes — 20% on long-term gains and 39% on short-term gains

- Taxes on repatriated income: Yes, if you’re a resident

Because of Japan’s global reputation for quality manufacturing, it’s produced a slew of high earners at the top of multinational corporations — all of whom the country taxes heavily.

Japan’s tax brackets top out at 55%, which puts it squarely among the highest tax rates in the world.

This is also partly why the country has a hard time attracting foreign executives. While Japan is one of the few Asian cultures just as popular as Western cultures, there aren’t many foreigners who could feasibly live there long-term.

Japan puts its tax income to work by investing in social welfare and education (e.g. facilities for elderly, children, and people with disabilities), public health and sanitation, food production infrastructure, civil engineering, and commerce.

3. China

- Income tax: 33% (on annual income of 538,406.40 yuan, or USD84,000)

- Capital gains taxes: Yes, if you’ve lived there for more than five years

- Taxes on repatriated income: Yes, if you’ve lived there for more than five years

China has come a long way from its reputation for dirt cheap manufacturing. In 2021, it reported 626 billionaires — quickly catching up to the 724 in the United States. Top earners see a 45% tax rate on their income.

But even with these stories of fame and fortune, 600 million of China’s 1.4 billion people live on barely 1,000 yuan (USD$155) a month. About three-quarters of these live in rural regions.

That means the country’s current level of prosperity is riding on its billionaires along with the rest of the middle class in the country.

China is working steadily to lift its population out of poverty. A World Bank study suggests that between 1990 and 2016, 745 million people were raised out of extreme poverty (under $1.90 a day). If China succeeds in raising its 600 million poor citizens to middle-class standards, it could overtake the US in GDP.

4. India

- Income tax: 20% (on annual income of 6135053.40 rupees, or USD84,000) on worldwide income if you’re a resident

- Capital gains taxes: Yes

- Taxes on repatriated income: Yes

Along with China, India is one of Asia’s fastest-growing economies. The country’s sizable population means fierce competition for jobs.

But because of the country’s huge geographical expanse, India is heavily divided. Caste systems, subcultures, religions, language — you’ll run into a lot of politics living in India. Nobody likes it, but for the most part, they’re used to it.

That said, the culture does have a lot going for it. Lots of diversity and new things to try, which will keep curious minds enthused and engaged. If you happen to land a good job, it’s most likely to be in one of the megacities.

Social support in India is low, given the low per capita income. Public healthcare is free for all Indian residents, although the infrastructure could use a boost along with more accountability and transparency.

5. Taiwan

- Income tax: 20% individual income tax (on annual income of 2,328,102.00 New Taiwan Dollar, or USD84,000) + flat rate of 20% on Income Basic Tax (IBT)

- Capital gains taxes: Yes

- Taxes on repatriated income: Yes, if the foreign-sourced income is >1 million NTD. But foreign taxes paid on this income can be credited against the 20% IBT.

If you combine the Individual Income Tax with Taiwan’s Income Basic Tax, Taiwan actually has steep personal income tax rates — putting it above even South Korea, the #1 on this list.

The high tax rates are why it’s hard for Taiwan to attract talented professionals even though the cost of living in Taiwan is low. This creates a vicious cycle: skilled professionals don’t want to work in Taiwan, leaving output and wages stagnant while social welfare needs consistently increase.

Government expenses went mostly to social welfare and education (44.7%) in 2017. Defence was the next highest with 15.5% of the budget — unlike Hong Kong, Taiwan maintains its own military.

Putting it all into perspective though, Taiwan is still a great place to live. An easygoing and hospitable people, great healthcare, excellent infrastructure are all attractive points of consideration.

A Final Note

Personal income tax rates only tell one part of the story.

For example, Brunei doesn’t impose hefty income taxes on individuals, but it’s also a Muslim country under Sharia Law. Foreigners who move there may be in for a huge culture shock if they’re from a country that isn’t as strict regarding modesty of dress, physical contact with the opposite sex, and alcohol consumption.

It’s also good to consider things like what countries are the best places to live long-term, including aspects such as raising a family and the culture’s hospitality.