Singlife has been turning heads with its promise of higher interest rates beating regular savings accounts, Singapore Savings Bonds, and even fixed deposits. After all, who wouldn’t want to earn more money with their savings?

That said, with their recent rate change (July 2021), is the Singlife Account still as attractive as before?

Today, we’ll uncover essential details about the Singlife Insurance Savings Plan to help you decide if it’s still a good place to sink your money into.

Here’s what we’ll cover:

- What is the Singlife Account? How does it work?

- What are the benefits of a Singlife account?

- Is it worth getting the Insurance Savings Plan?

- Singlife vs StashAway Simple

- For whom is the Singlife account best for

What is the Singlife Account? How Does It Work?

The Singlife Account doubles up as both a savings account and insurance coverage. But don’t mistake this for a regular bank account or fixed deposit.

There are two main components to the Singlife Account, so let’s pick them apart and take a closer look at their features:

1. Savings

Even though Singlife’s interest rates have dropped since July, they’re still decent compared with regular savings and fixed deposit accounts in the current economy.

| Deposit | Singlife Interest Rates (p.a) |

|---|---|

| S$500 to S$10,000 | 1% Additional 0.5% when you spend at least S$500 monthly on Singlife Visa Debit Card |

| S10,001 to S$100,000 | 0.5% |

| Above S$100,000 | None |

It takes just S$500 to open an account with Singlife. Thereafter, you’ll need to maintain a minimum of S$100 to keep getting interest on a monthly basis.

You’ll get the maximum returns (1.5%) when you park up to S$10,000 with them and spend S$500 monthly on the Singlife Visa debit card. But the interest rate drops the more money you park with them — you won’t get anything extra above S$100,000.

There’s no lock-in period, so account holders can make a FAST transfer at any time and get their funds almost immediately. You won’t even have to pay extra fees for this, which is a huge plus compared to fixed deposits.

The Singlife Visa Debit card also has no annual subscription or foreign exchange fees. It doesn’t work with mobile payment apps like Apple or Google Pay yet, but Singlife assures us that this feature will be available soon.

2. Insurance

As a Singlife account holder, you’ll receive life insurance and retrenchment coverage:

| Life Insurance Coverage | Retrenchment Coverage |

|---|---|

| Coverage for death or terminal illness is up to 105% of account value | Retrenchment benefit for three months, up to S$10,000* |

The retrenchment coverage is a timely offer considering how Covid-19 is still looming and causing much instability in the economy. Just make sure to read the fine print because there are few clauses that may affect your claims.

For example, here are some exclusions that you should take note of:

- You were aware that you’d be retrenched before buying the policy

- You’re self-employed, a freelancer, or a sole proprietor immediately before being retrenched

- Your unemployment is due to resignation, retirement, redeployment and temporary layoffs

- Your retrenchment was due to misconduct, breach of employment contract, or labour dispute

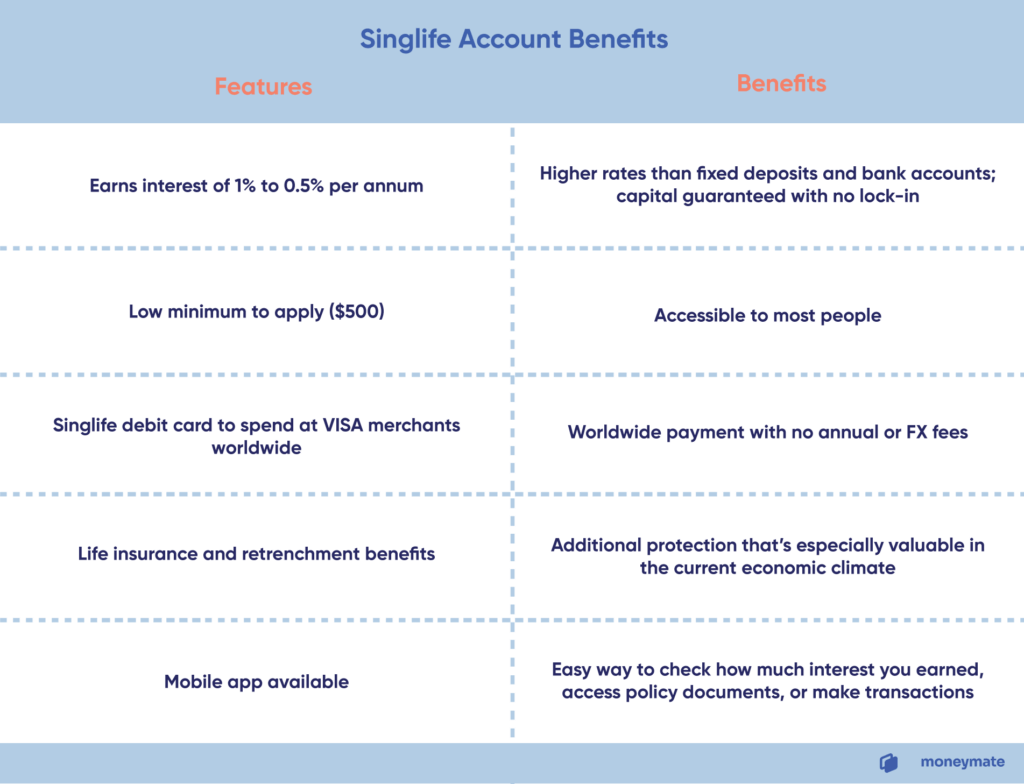

What are the Benefits of a Singlife Account?

Let’s take a look at what the Singlife Account offers:

Is It Worth Getting an Insurance Savings Plan?

An insurance savings plan sounds attractive for those who value convenience. You don’t have to deal with two separate accounts and you get a higher interest rate on top of that coverage. So, why not?

If you dig a bit deeper, you’ll notice a few weaknesses in the plan.

For one, a big part of the premium goes to investment and a smaller portion goes to mortality charges. That means the coverage would be significantly lower than if you buy full-fledged life insurance.

Secondly, you’ll get a team of managers investing your funds. Unfortunately, the returns will never be quite as substantial because a large chunk of it went into paying the fund managers for their work.

This is why the returns for such insurance savings plans can sometimes lose out to cash management or investment-related accounts. We’ll talk about one such comparison in the next section on SingLife vs StashAway Simple.

Singlife vs StashAway Simple

How does a Singlife account compare with a cash management account like StashAway Simple™? Here’s a quick overview of the differences:

| Singlife Account | StashAway Simple™ | |

|---|---|---|

| Minimum to start | S$500 | None |

| Minimum monthly balance | S$100 | None |

| Interest rate per annum | 0.5 to 1%* | 1.2% |

| Withdrawal fee | No | No |

| Other chargeable fees | None | Around 0.217% charged by the underlying fund managers |

| Lock in period | None, can withdraw anytime | None, can withdraw anytime |

| Accepts Supplementary Retirement Scheme (SRS) funds | No | Yes |

| Insurance coverage | Yes | No |

| Projected rate subject to change | Yes. It is a capital-guaranteed insurance savings plan. Returns are not guaranteed. | Yes. Returns are affected by Singapore’s economic health and trajectory. |

Where Singlife wins:

- No cost to maintain

- Insurance coverage for death, major illnesses, and unforeseen retrenchment

- Capital guaranteed

If you find the insurance portion useful because you don’t have sufficient coverage from existing policies, the Singlife account could be a convenient option that combines both saving and protection.

Another highlight is Singlife’s “capital guaranteed” clause. Even in the worst economic climate, account holders can still recoup their capital. With StashAway Simple, there’s a tiny chance of losing your capital if the market goes south.

Where Stashaway Simple™ wins:

- No tiered earning structures; flat 1.2% per annum in interest

- Account flexibility extends to facilitating SRS management

- No minimum sum to start an account and no monthly balance to maintain

StashAway Simple™ does away with complicated calculations and offers a flat rate of 1.2% that beats Singlife hands down. It’s a way better deal for those looking to park larger sums of cash.

Assuming you put S$50,000 in StashAway Simple, you’ll get S$600 in interest. But with Singlife’s tiered structure, you’ll only get S$300.

Even assuming you spend S$500 a month on the Singlife card to get an extra 0.5% interest, you’ll only have S$350 in interest for the year.

If you prefer a straightforward account that earns higher interest and you’ve got no need for additional insurance coverage, StashAway Simple is the better option. Being able to use your SRS funds is an extra perk as well.

Read also: Best High-Interest Savings Accounts for Singapore

The Singlife Account is Best For…

- Those who love the convenience of combining their savings and insurance so they don’t have to handle multiple accounts

- Those with lesser cash on hand but would like to receive higher yield than a regular bank account

- Those who aren’t sure they’re ready to commit to a long-term life policy

But the Singlife account is not suitable for:

- Those who want to use their SRS funds

- Those who are investment-savvy and can get higher returns by managing their own investments