As of 9 June 2021, a Category A COE goes for $48,510.

What if you could get it at half that price?

No, we aren’t selling snake oil here.

We’re just proposing a hypothesis that you may want to consider — if you’re wondering whether there’s a best time to buy a car.

(Read also: How Much Does It Cost to Own a Car Over 10 Years?)

This hypothesis is based on the idea that just as there are business cycles in the macroeconomic environment, COE prices also run in cycles.

If you buy at the top of the cycle, you’re paying a premium. But buy at the low of the cycle and you’re getting a hugely discounted rate.

We’ll detail our hypothesis in this article.

The Stock Market as an Analogy

Let’s set the foundation before we move forward. (If you’re already an experienced investor, you can skip ahead to the next section.)

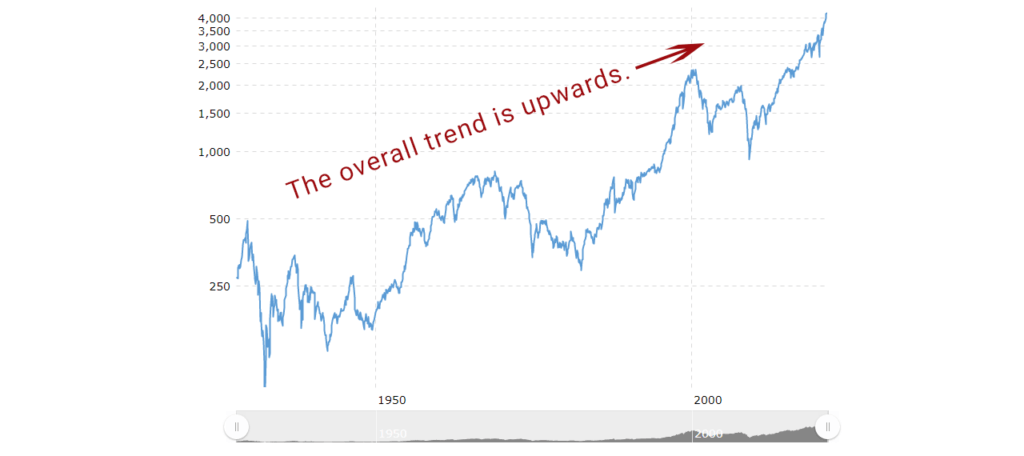

This is the price history chart for the S&P 500, one of the major stock market indices:

The data goes as far back as January 1928.

Notice that even though there are spikes and dips in the chart, the overall price trend is upwards. This is because of factors such as the growth of the global economy, inflation, more currency in circulation, and so on.

This should come as no surprise. You used to be able to get a bowl of prawn noodles for $0.50. Now, you’re lucky if you find one that’s 7x the price.

But more importantly, the 93 years depicted in the chart can also be sliced into approximately 10 to 12-year business cycles. You’ll see a repeated cycle of:

- businesses doing well and prices increasing

- the economy peaking

- …followed by a slowdown and possibly a recession

- and then a gradual recovery back to an expanding economy

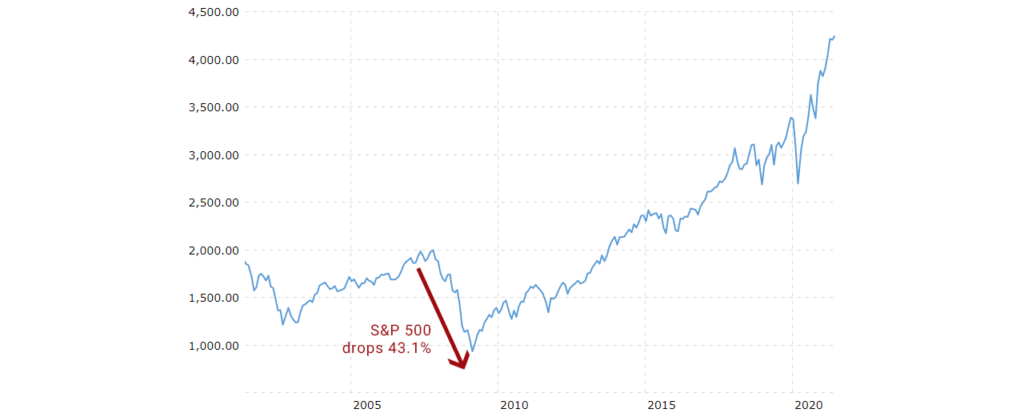

The last recession was in mid 2007 to 2009. This was the Global Financial Crisis.

The next was 12 years later — when the pandemic first struck in 2020. (The recovery has been uneven, but overall this recession didn’t last very long because of all the economic stimulus and aid packages.)

The Principle of Business Cycles

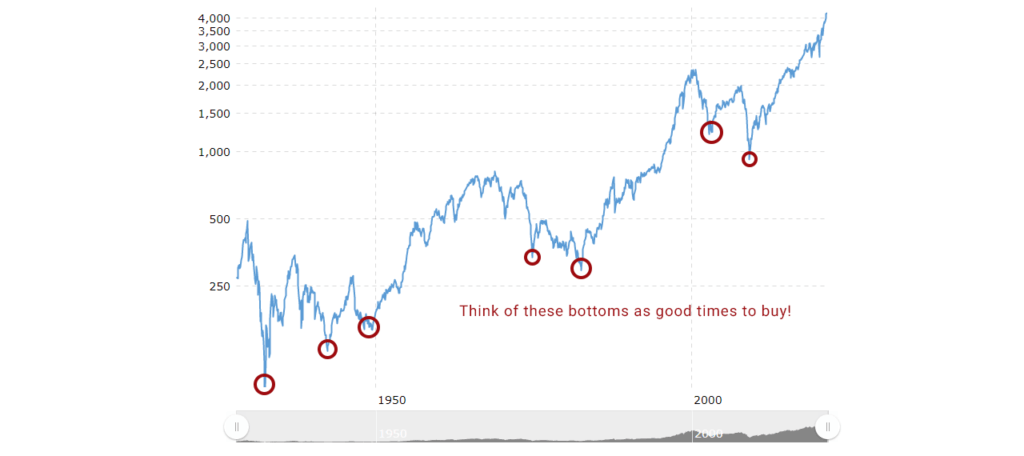

On a broad level, where you are in the business cycle tells you when it’s time to buy or sell.

We’ll use an example to illustrate.

Say you’d invested $10,000 in the S&P 500 in Feb 2009 and then just left it there. Today, it would be worth $45,593.10. That’s a 356% increase over 12 years compared to the measly 2% wage increase you get every year (if that).

But the times you invest make a difference. If you’d invested the money in Oct 2007 for example (just before the 2008 recession), you’d only have $21,309.67 now, or a 113% increase from your initial $10,000 investment.

The lesson here:

The beginning of a cycle is the best time to buy.

Adopting a long-term view pays off when it comes to the business cycle. We’re thinking the same principle applies to COE prices.

Let’s explore this further.

Category A COE Price History Chart

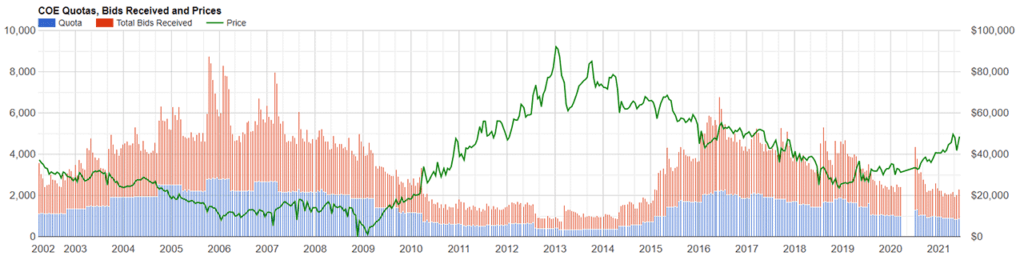

Though the COE system was introduced in 1990, we only have data from 2002 onwards as this was when LTA started holding two bidding exercises per month.

Looking over the chart, you’ll notice:

- The highest COE price in Singapore history was $92,100 on 9 Jan 2013. Interestingly, this coincides with one of the lowest total bids received for the entire 19-year period.

- The lowest COE price in Singapore history was $2 on 19 Nov 2018.

- It took about 4 years from the bottom ($2 on 19 Nov 2008) to the top ($92,100 on 9 Jan 2013).

- It took about 6 years for that top to come down to the next low ($23,568 on 5 Dec 2018).

- The peak occurred roughly midway through the 10-year period.

The $2 low also coincides with the 2008 financial crisis: the S&P 500 had dropped 43.1% off its all-time high. No one knew when it was going to recover.

(The bottom was in by Feb 2009, in case you were wondering.)

COE prices didn’t stay at $2 for long though. By the next month, it had rebounded to $7,721.

The next lowest bottom was 2 months later in Feb 2009: $1,020. This coincides with the equity market bottom.

The Best Time to Buy a Car

From the historical chart, it seems that COE price cycles are roughly equivalent to the 10-year business cycles.

That means that we’re a few years into the current cycle, and prices are likely to keep rising from here on out. COE prices may peak in 2023 to 2025.

If you can’t wait until the start of the next cycle, now would be a good time to buy a new car. Alternatively, you could get a resale car that was registered at the end of 2018.

Otherwise, the next best time to buy may be around 2029 to 2031.

Read also: Cost of Car Ownership [Singapore vs The Rest of the World]